Mortgage Market is Ripe for New Homeowners

When you’re thinking about buying or building a new home, finances are always top of mind. Securing the right mortgage at the right time can mean saving thousands of dollars or paying down your debt faster than you thought possible. Fortunately, as of January 2021, the mortgage market is very favorable for homebuyers. Here’s how you can make the most of current mortgage interest rates to build your beautiful new home.

Mortgage Interest Rates Are Low–For Now

Among the many headlines vying for attention in 2020, one bright spot of good news for potential homeowners was the steady decline of mortgage interest rates. The year closed with rates at historic lows. According to Freddie Mac’s Primary Mortgage Market Survey for the week ending December 31, the average interest rate was 2.67% for 30-year mortgages and 2.17% for 15-year mortgages. That’s a significant drop, even compared to just a year or two ago.

If you’re dreaming of a new home, you’re probably wondering one thing: Will rates continue to drop? It’s hard to say. A forecast from Forbes predicts that 30-year mortgage rates could rise modestly over the course of 2021, ending the year near 3.1 to 3.3%. That may not sound like much, but even a small uptick in the interest rate can cost you thousands over the course of a loan. There’s a chance that rates will continue to fall, but this isn’t a given. With the volatility we’re seeing in the economy and mortgage market, why not lock in favorable rates now?

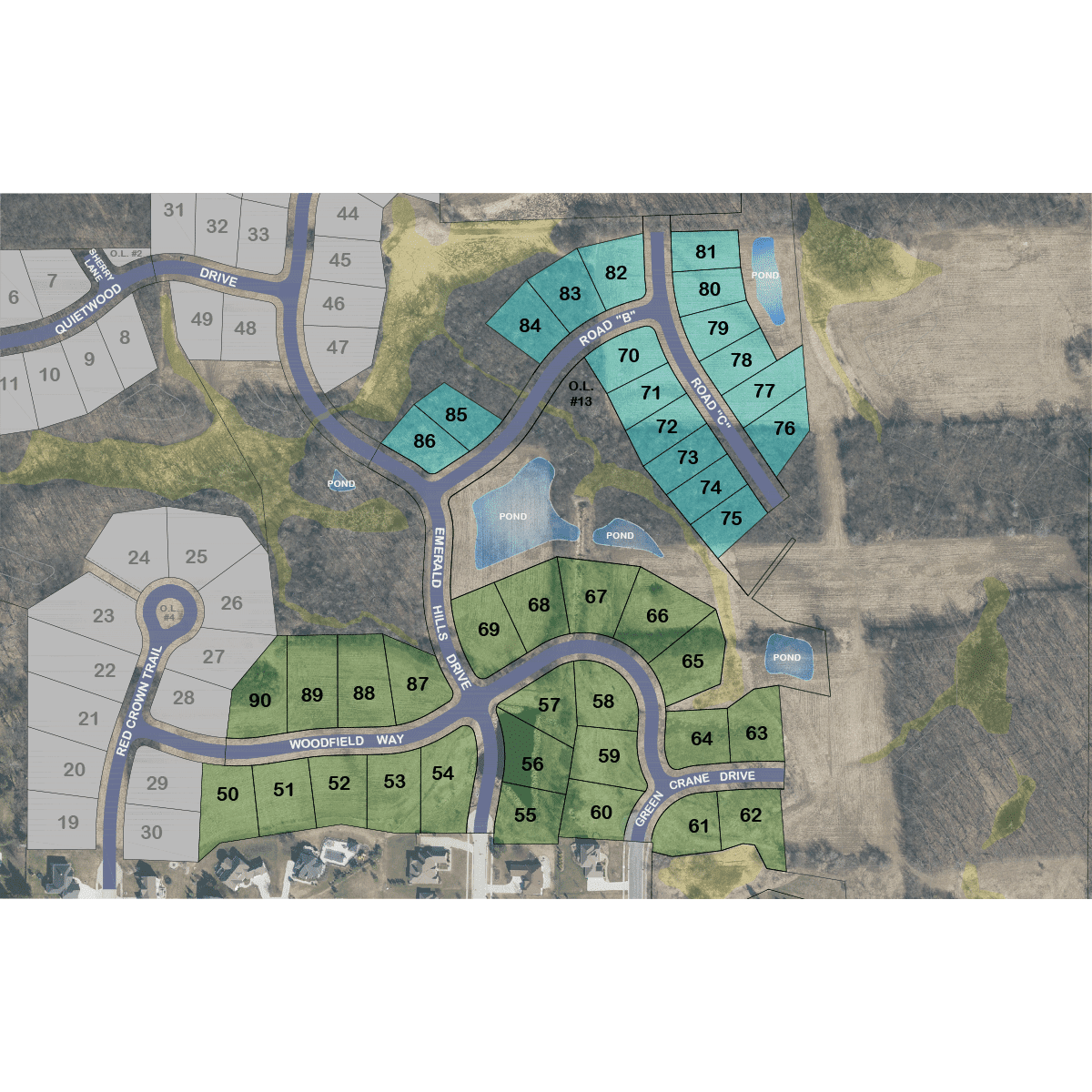

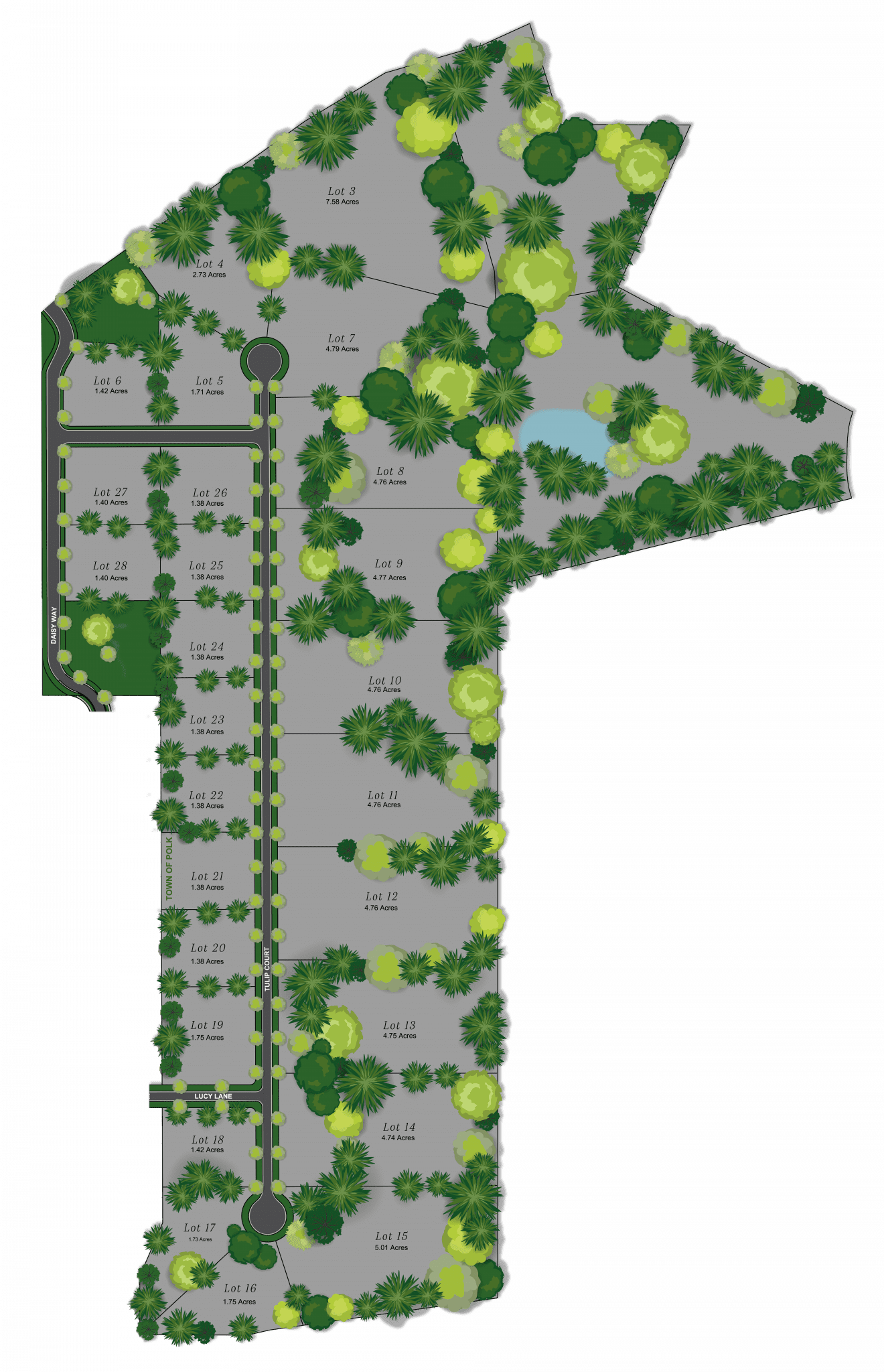

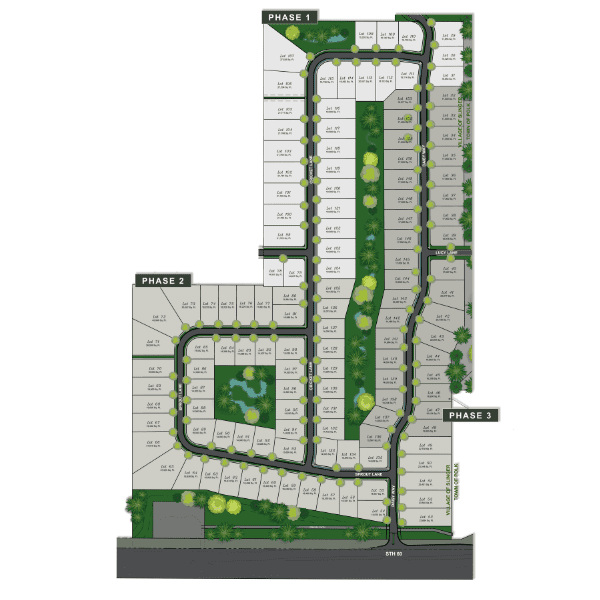

Low interest rates have caused the demand for housing to skyrocket. Right now, demand is outpacing inventory. Houses are selling fast, and homebuyers are settling for what they can find instead of the home of their dreams. Even with affordable financing on your side, you might not find an existing home for sale that works for your family. One surefire way to solve this issue is to build a new home that’s customized to suit your lifestyle. Right now, money is cheap, and new construction is the certain way to lock in pricing that works for your budget. You can take advantage of today’s interest rates to build tomorrow’s “home sweet home” with Demlang.

Rate information is constantly changing. If you’re interested in financing a new home, check with your financial institution for current rates and to create a financing plan that works for you.

Get More Home For Modest Monthly Payments

One of the best parts of today’s low interest rates is that you can afford more home than ever before. Even with the increased price of building due to issues like lumber shortages, you’ll still be able to have your dream home for remarkably affordable payments. If you’ve been on the fence about building a new home, the time to act is now.

To illustrate, let’s suppose you’ve been considering building a new home with a total property value of $450,000, including the lot/land. You intend to make the standard 20% down payment and finance the rest with a 30-year mortgage. For simplicity’s sake, we’ll leave out taxes, insurance, HOA dues, or anything else included in an escrow payment. If you had originated that mortgage loan just two years ago, when interest rates topped 4.5%, you’d end up paying nearly $135,000 more than you would for a new loan starting today–and that’s just interest!

| Now (2021) | Before (2019) | |

| Property Value | $450,000 | $450,000 |

| Mortgage Amount | $360,000 | $360,000 |

| Interest Rate | 2.67% | 4.51% |

| Monthly Payment | $1,454 | $1,826 |

| Total Interest | $163,692 | $297,517 |

| Total Payments | $523,692 | $657,517 |

To get a little more square footage or unique features, you might be interested in a home and lot package with a total value of $500,000. Building that ideal new home now will save you over $400 monthly, and nearly $150,000 total, compared to a mortgage that was taken out in January 2019.

| Now (2021) | Before (2019) | |

| Property Value | $500,000 | $500,000 |

| Mortgage Amount | $400,000 | $400,000 |

| Interest Rate | 2.67% | 4.51% |

| Monthly Payment | $1,616 | $2,029 |

| Total Interest | $181,796 | $330,530 |

| Total Payments | $581,796 | $730,530 |

In fact, you could afford a $565,000 property and still make lower monthly payments than you’d be making on a $450,000 property that originated in January 2019. And you’d still be paying far less in total interest–$205,000 instead of $297,000. Spending more of your hard-earned money on your dream home (and less on interest) seems like a win to us.

Own Your New Home Even Faster

A traditional 30-year loan isn’t your only financing option for your custom dream home. If you’d rather own your new home sooner, and you don’t mind paying a little more each month, consider a loan with a shorter lifetime. Interest rates are down across the board, making these options more attractive than ever. With some smart planning, you can own your forever home before you enter retirement.

Let’s consider those same property options as before, but this time, we’ll take a look at different loan options at today’s going interest rates. Here’s what your monthly payments would look like for different mortgage lengths, not including escrow payments.

| 30-year Current rate: 2.87% Payoff Date: Jan. 2051 |

20-year Current rate: 2.73% Payoff Date: Jan. 2041 |

15-year Current rate: 2.34% Payoff Date: Jan. 2036 |

10-year Current Rate: 2.32% Payoff Date: Jan. 2031 |

|

| $450K Property | $1,492 | $1,948 | $2,370 | $3,364 |

| $500K Property | $1,658 | $2,164 | $2,637 | $3,738 |

With a 10-year loan, you could own your new Demlang home as soon as January 2031!

As a reminder, this information is subject to change. Visit our resources page for a mortgage calculator to explore how different financing options will work for your budget and home ownership goals.

The Time to Finance Your New Home Is Now

Whether you want to pay off your mortgage sooner or keep monthly payments down, low interest rates mean the time is right to start building your dream home. Learn more about financing your Demlang home, or schedule a meeting with a New Construction Specialist to discuss financing options.