How Commodity Prices Affect the Cost of New Construction

The current hot topic in the housing industry is the price of lumber. Is it rising or falling? How is this affecting new construction? When you’re building a home and see the headlines about lumber prices coming down from the historic highs triggered by the pandemic, it feels like your lucky day. However, the market trends for lumber and other commodities are complex, which means that the price of a new home won’t necessarily fall as these indices fall. Let’s take a look at the economics of building materials and how they affect your home.

Lumber Price Changes Are Fluctuations – The “Acute vs. Chronic” Problem

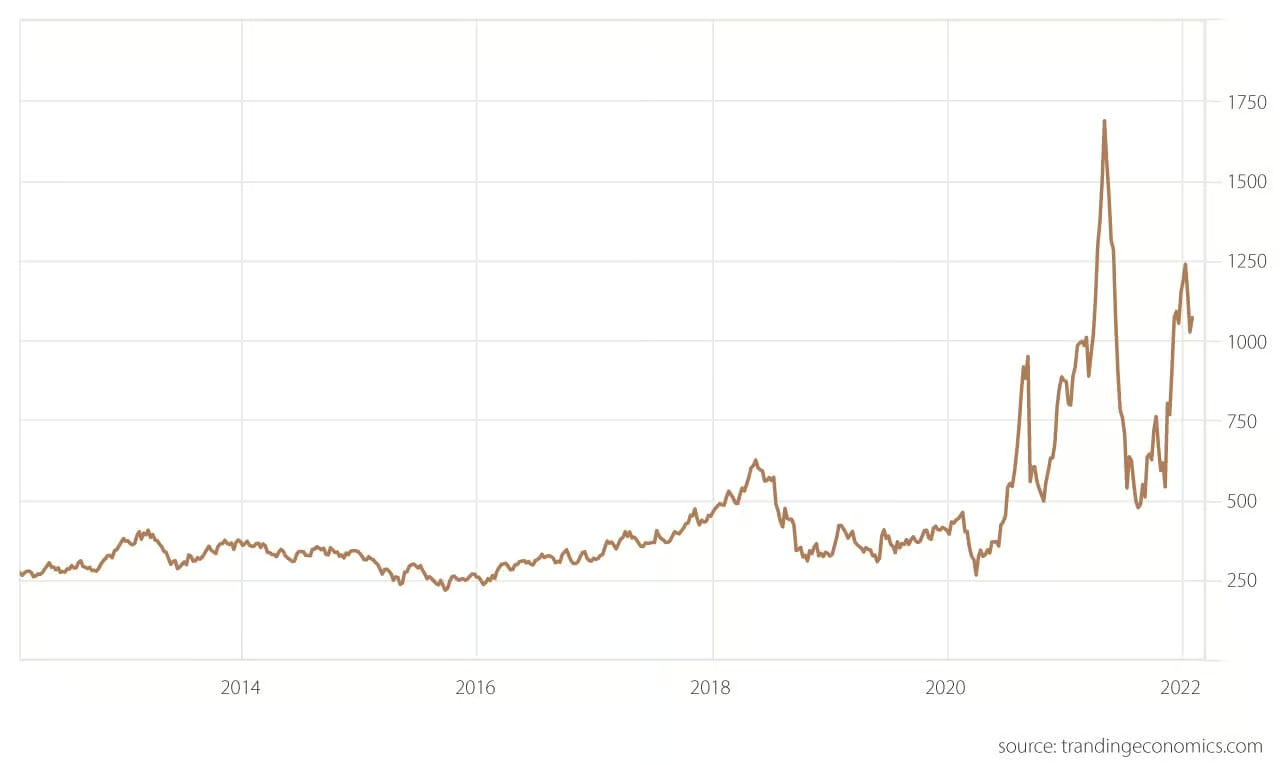

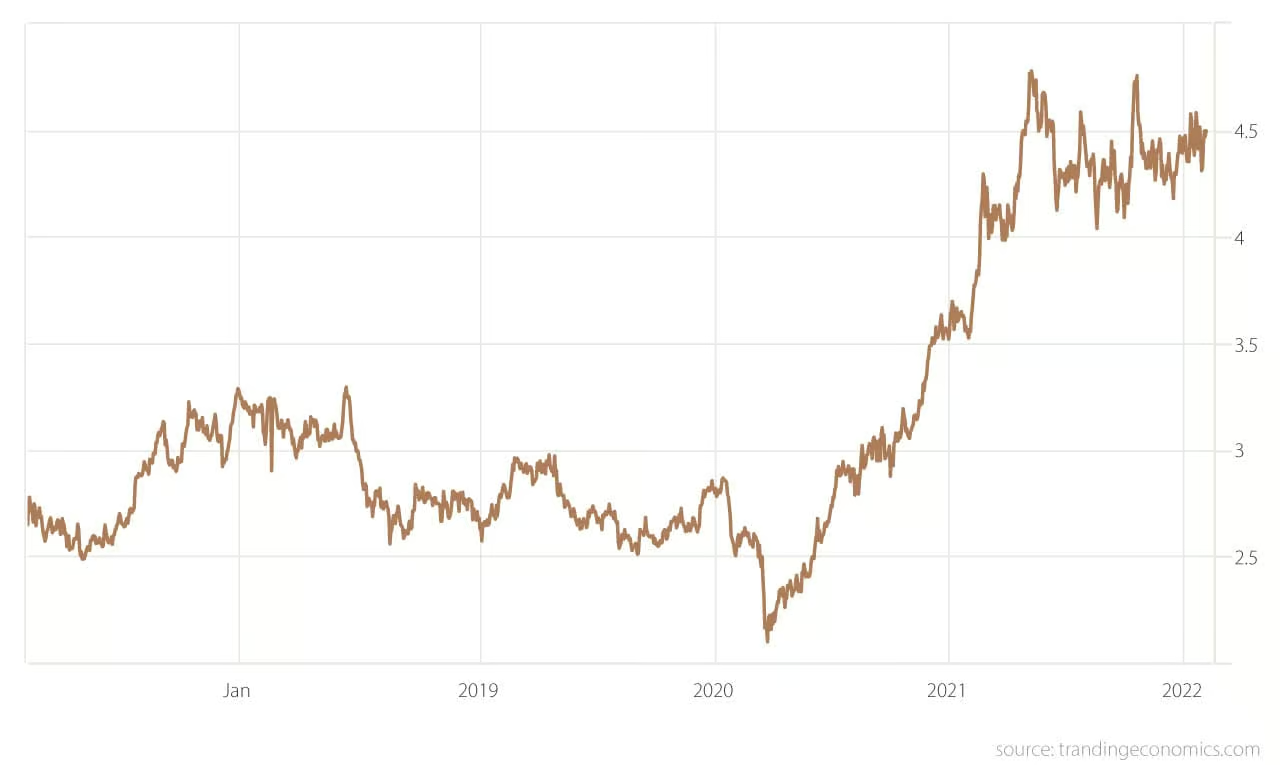

When you see news reports about the price of lumber dropping, it’s important to understand the scope of these changes. In a narrow, short-term sense, prices have dropped. However, over a longer horizon of time, lumber is still much more expensive than it was even five years ago.

Think of the difference between acute and chronic pain. Acute pain is a temporary but sharp change, whereas chronic pain is a long and ongoing problem. Soaring prices for lumber are part of a chronic multi-year trend. The recent drops are relatively small fluctuations within the larger trend.

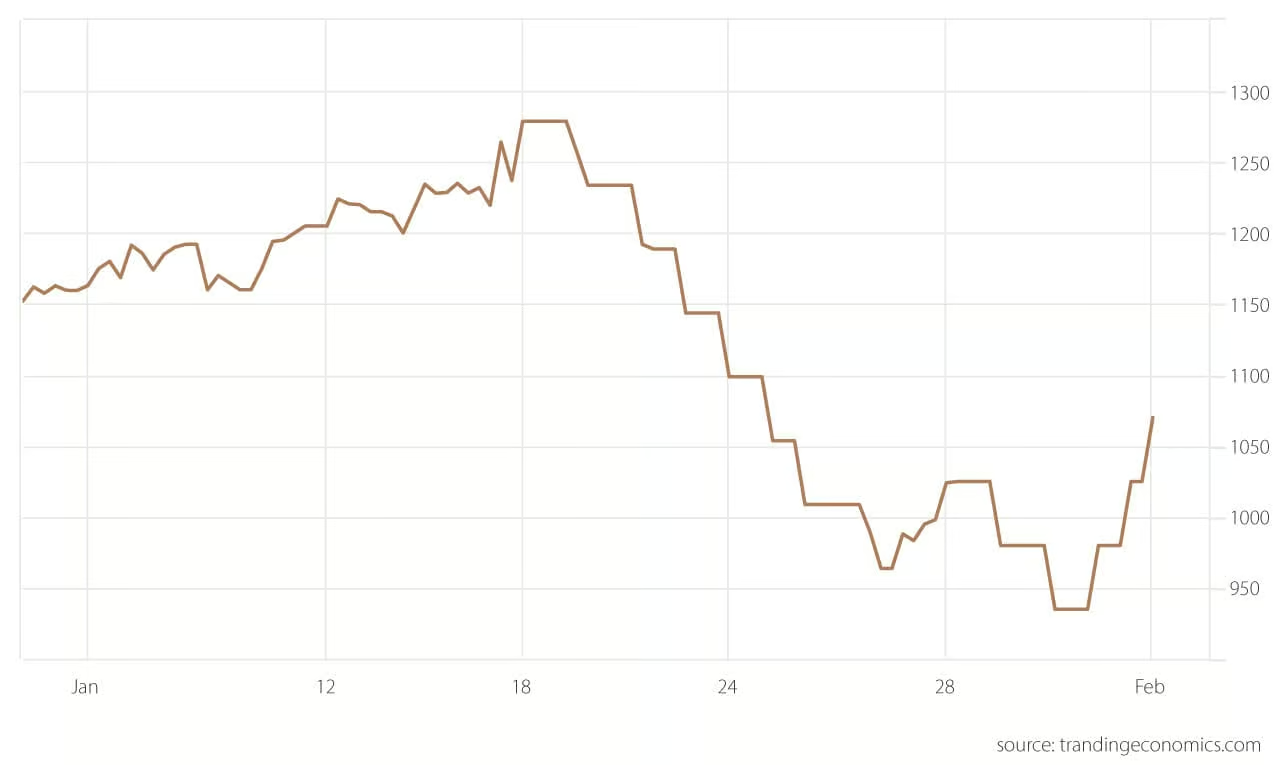

This graph of lumber prices for the first weeks of 2022, showing a recent drop, looks promising.

However, when you look at the lumber market over the last 10 years, there is an overall upward trend. Especially since the start of the pandemic, prices are high and they’re highly volatile. The volatility also contributes to higher housing prices–when material prices fluctuate wildly, suppliers keep their own prices high to absorb risk and builders can’t easily expand their output. This article from MarketWatch details how volatile lumber prices are affecting the full span of the housing market, including rentals and other housing alternatives.

Commodity Prices and the Futures Market

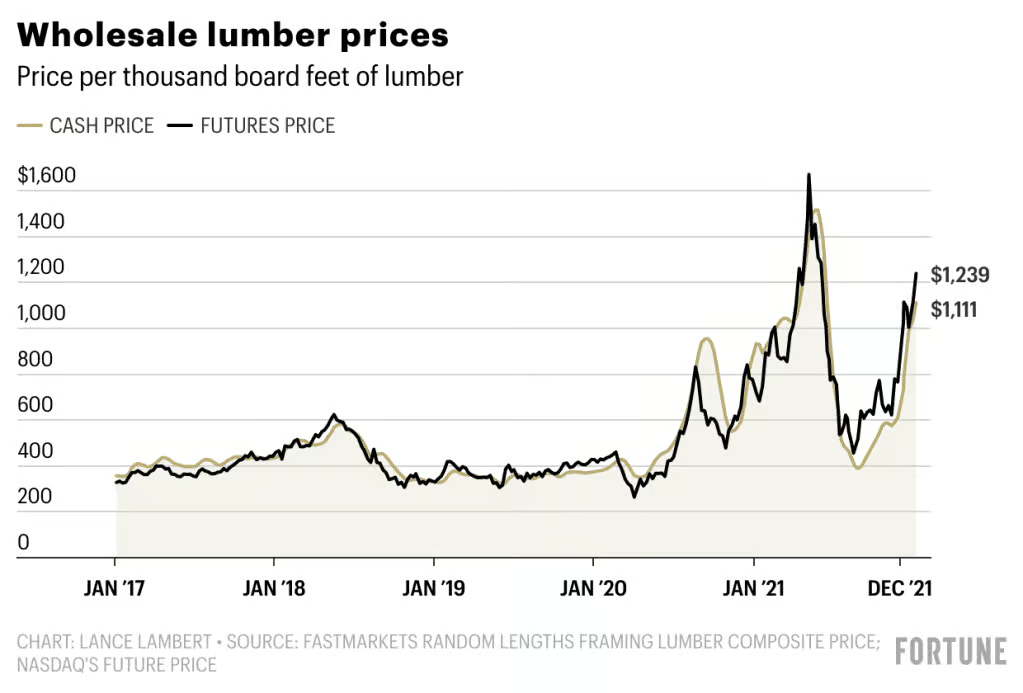

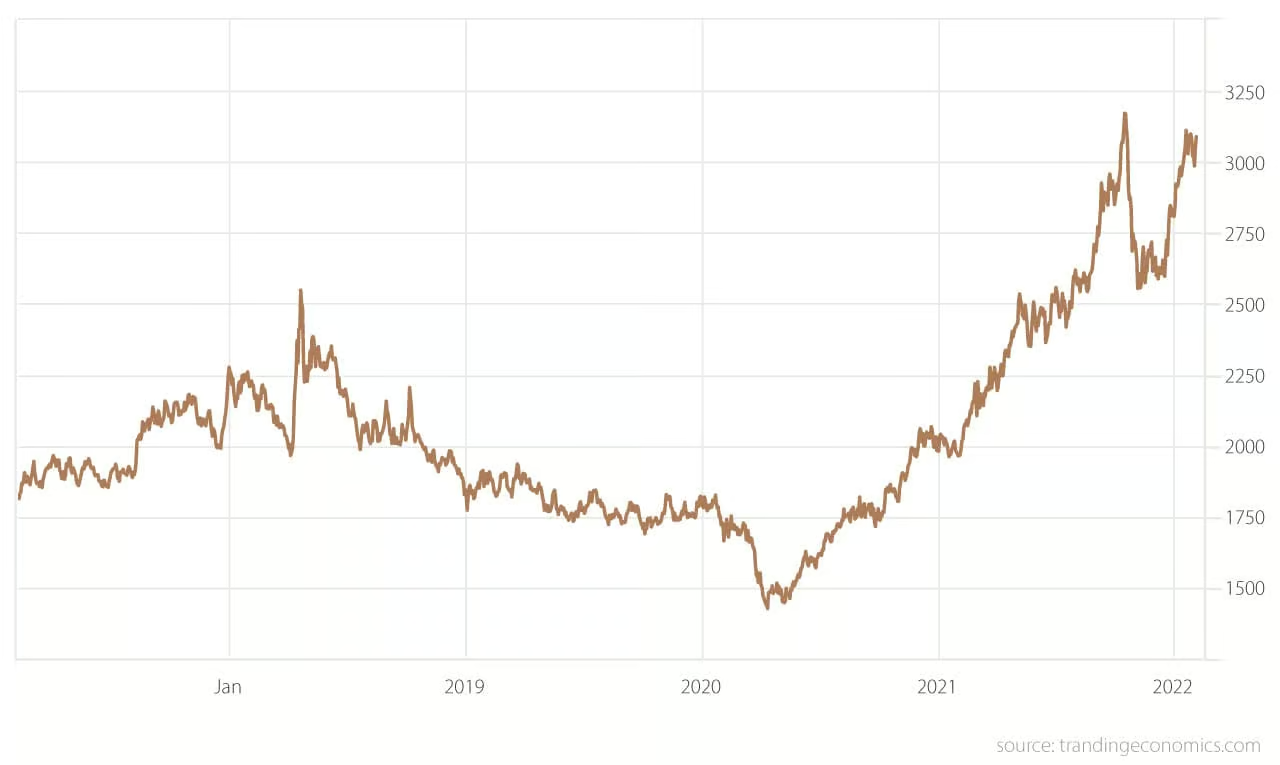

Due to the intense volatility of supply, demand, and pricing, lumber, and other commodity materials are traded on the futures market. In this arrangement, buyers and sellers sign a contract for the materials to be provided in the future for an agreed-upon price. The seller (e.g. a lumber mill) is hoping to avoid the risk of plunging prices and carrying costs, while the buyer (e.g. an investor) wants to capture profit from a market spike.

What does this mean for new home construction? The price indices you see on the news don’t reflect the actual price of the materials on that day. There is always a delay, which causes a price gap. This graph from Fortune demonstrates this effect and how it has affected lumber prices.

In an article for CNBC, David Logan from the National Association of Home Builders (NAHB) described this as “sticky” pricing, adding that the phenomenon helps to explain why housing prices are slower to recover than lumber prices. In addition, the NAHB notes that actual output continues to lag behind demand, lengthening the relevant timeframe for material prices.

At Demlang, we purchase the lumber needed for a house well in advance, sometimes 6 months out from the start of a project. We’re absorbing the risk of future price fluctuations and working with what materials cost in the past when they were ordered. A spike or drop in today’s market price for lumber won’t be reflected in the cost of your in-progress home. There is also a delay between when pricing changes, the lumber yard’s prices are adjusted, and new home base prices are recalculated–meaning it may take several weeks or even months for pricing changes to be reflected.

Price Trends for Other Building Materials

A house is much more than lumber. Every component, fixture, and finish in your new home has its own dynamic price market driven by supply and demand, among other factors. Even when lumber prices begin to come down, the prices of other materials and commodities play a role in the overall investment of a new home.

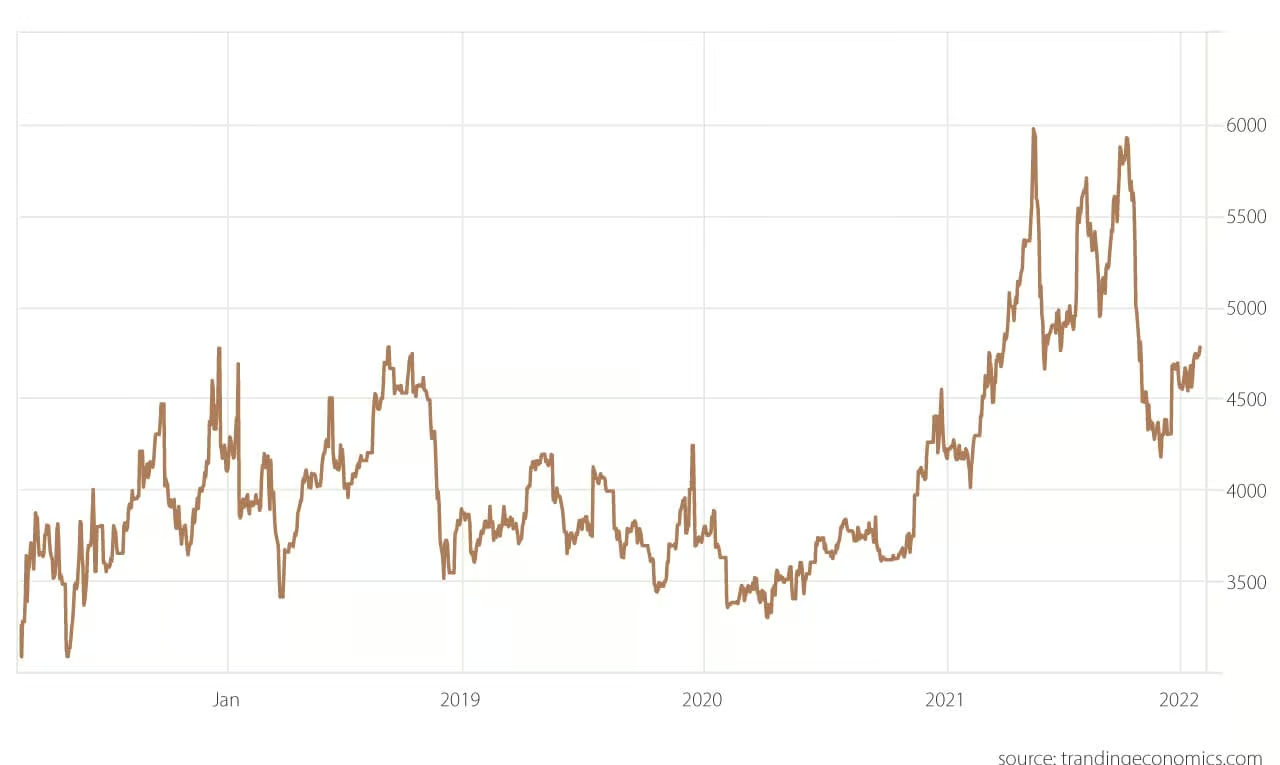

For example, steel is critical to the construction of your home, from foundations to joists. It’s also a commodity that’s traded on the futures market. And much like lumber, steel has recently risen in price substantially.

Similar trends can be seen in the market for copper, which is used in your plumbing and electrical, and aluminum, which is used for everything from garage doors to gutters. According to Business Insider, commodities are facing such severe shortages and cost jumps that some builders are even relying on retail stores like Home Depot to supply their construction materials.

The price of a new home is impacted by other forces beyond the cost of materials. Like many other industries, the housing industry is contending with a shortage of skilled labor, complications with logistics, tariffs, embargoes, and more. For details about how Demlang Builders is successfully handling these factors, check out our recent blog: Supply Chain Challenges, Demlang Solutions.

Economic Factors Signify That It’s Time to Build

If you’re hesitant to sign up with a builder, it’s important to know that now is still the best time to start building. The price of a beautiful new home likely won’t go down, even as lumber and other material costs stabilize. We’re working closely with our suppliers and partners to get the in-demand materials we need for your home. To learn more about how Demlang helps get you into your new home, contact one of our New Construction Specialists.