Know the Steps to New Home Construction Loans

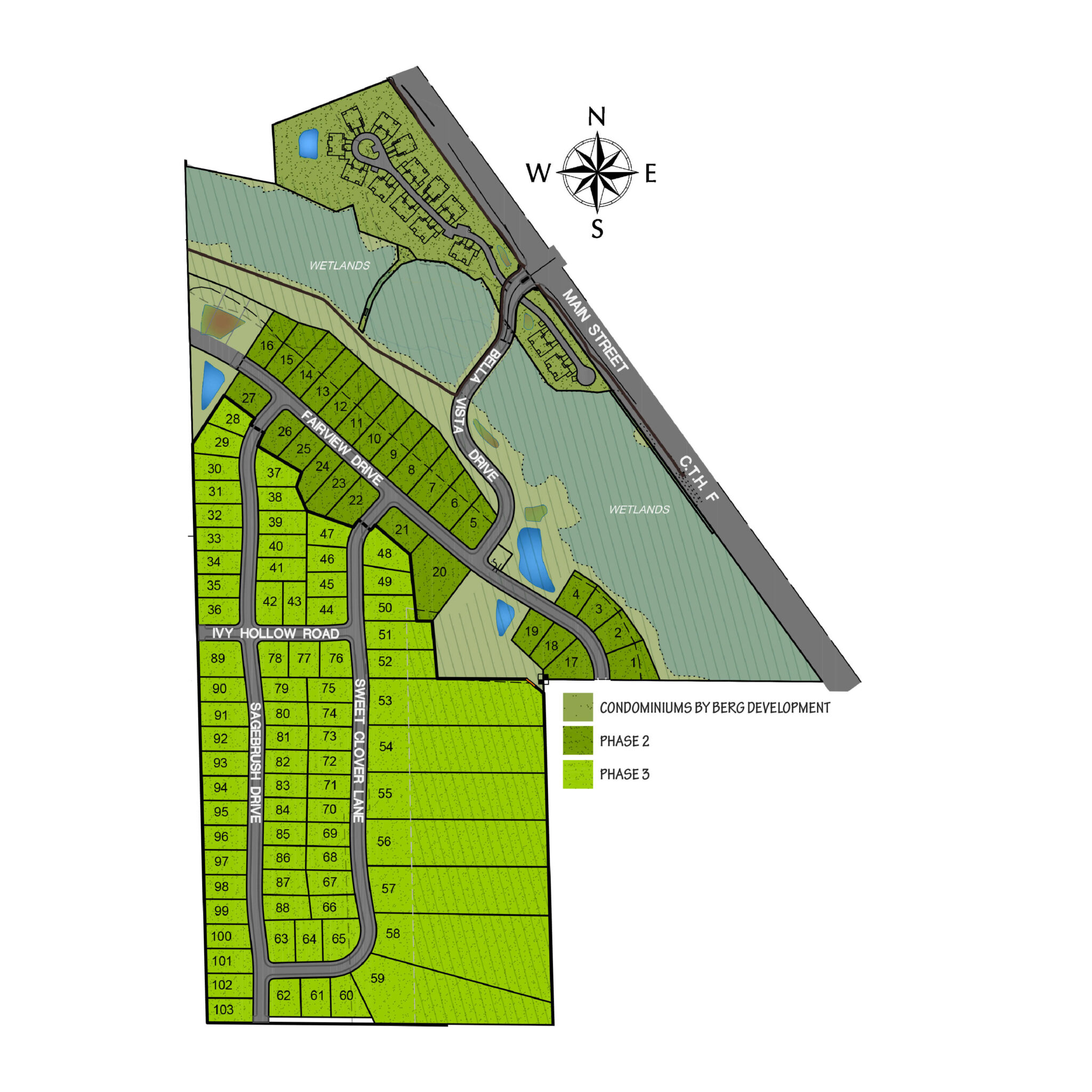

Finding the perfect floor plan and your preferred lot location top the list of the many exciting decisions you’ll be making on your journey to building your new home. How to pay for it and who to finance with will be another major decision.

Susan Vierck, Residential Loan Officer with Bank Mutual offers a step-by-step process to financing your new home construction.

FIRST THINGS FIRST – A BUILDER & HOME PLAN

So you’ve done your research, done some shopping and have decided on a builder, a lot and maybe even have selected a floor plan. Ideally, at this point you will have enough details of your project to determine the costs involved to build your dream home.

MEET WITH A LOAN OFFICER

Once you have determined your budget, your next stop will be with your favorite local bank. Schedule an appointment with a loan officer to discuss their loan programs and qualification process. A loan officer will also be able to help you determine what you qualify for and present various payment options and plans.

“What sets Bank Mutual apart from other lenders is our 30-year fixed rate program which locks you in at the beginning of the build process,” said Susan. “Simply put, we are a Wisconsin based lender and for borrowers that means local servicing and a smooth process. We are also one of few lenders who allow a 5% down payment. While it is important to put as much money down on your new house as possible to keep your mortgage low, it’s also not always a reality for everyone.”

A loan officer can pre-approve you, indicate the pre-approved loan amount and provide a formal loan commitment, if needed. This helps in finalizing your building plans and final contract price.

Susan informed us that Bank Mutual also offers a 7-year ARM option, which is a 30-year with the first 7 years locked in. “I want to make sure I am giving my borrowers all their options up front so they do not need to go through the process again. One and done!” stated Susan.

FINAL CONSTRUCTION CONTRACT SIGNED

Whew! All designs, specifications, and costs for your new home are finalized and the construction contract is signed. Next you will meet with your loan officer to finalize the loan application. They will complete the final loan processing and, upon approval, a loan commitment is issued and a date is set for the loan closing. Now it is time to set a building timeline.

APPRAISAL

Many people are surprised to find out that a new home must go through an appraisal process. But, instead of an appraiser walking the property like they can with an existing home, they use the construction documents, contracts, specs, and floor plans to determine the fair market value of your new house.

CLOSING YOUR CONSTRUCTION LOAN

You will meet with your loan officer or the title company to sign the final loan papers and necessary documents. Your bank will set up a construction escrow account for the amount of the construction contract (loan amount plus down-payment) to ensure sufficient funds are available for completion of your home.

CONSTRUCTION BEGINS!

Construction on your new home begins and your builder will ask for periodic or monthly draws as the construction proceeds. If you haven’t had a construction loan before, this process can be a little unfamiliar. Basically, your builder gets paid in increments based on what has been completed on the house. The builder will submit a draw request to the title company, who will authorize a draw to the builder and your bank will disburse loan funds to the title company. The title company acts as the gatekeeper of the money, making sure that all the stated work on that draw is complete, and then pay the builder in accordance with the terms of the disbursement agreement.

INTEREST PAYMENTS BEGIN

A 12-month construction period is set up where you will pay interest only on the amount of loan funds in use during each month. Each month an interest payment (plus escrow for Real Estate Taxes) will be due for the number of days loan funds were used during the previous month. As your builder requires additional draws, more funds are in use, and the amount of monthly interest that is due will increase. The monthly payment of interest will continue throughout the construction term.

YOUR NEW HOME IS DONE!

Upon completion of your new home, your builder will request the final draw on the construction contract. You and your builder will reconcile any overages or shortages from allowances in the construction contract. Your bank will have a final inspection done showing completion of the home. After your authorization, the final draw is made to your builder through the title company.

PERMANENT MORTGAGE STARTS

You will receive a final interest payment notice from the construction term. The following month, the loan repayment will begin with a full payment of principal and interest due.

Susan reported that the majority of her borrowers have had good building experiences. She feels finding the right builder, one that meets your needs and fits the size of your project is key. “Demlang has a wonderful team,” commented Susan. “I am happy to be an extension of their team!”